Unpacking SB 542 and HB 231 Property Tax Reforms

Part 8 (Series on Property Taxation in Montana)

November 6, 2025

By Greg Gilpin

Between tax years 2024 and 2025, the median residential home market value increased

by $67,000, a 22% increase. This caused many homeowners to see substantial increases in their

property taxes.

Montana’s 69th legislative session provided relief by enacting two significant bills,

SB 542 and HB 231, that restructured the Montana property tax system. These were the most important

changes to residential property taxes since 2009. This post details the tax changes

for 2025 and 2026 and then provides estimated impacts.

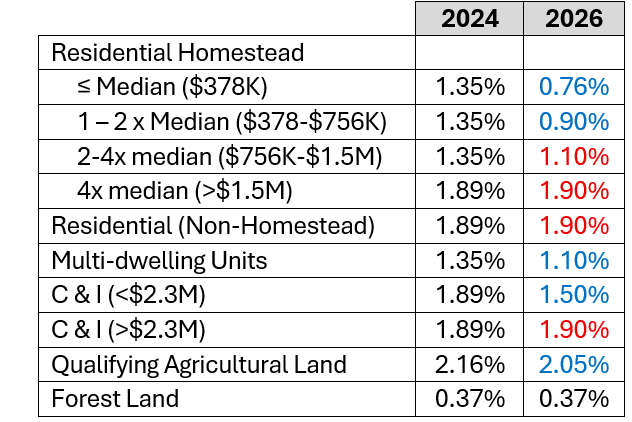

Enacted Property Tax Legislation Impacting 2025

In 2025, the Montana Legislature enacted sweeping changes to property tax rates by introducing a graduated property tax system based on the market value of residential

and commercial properties.

Table 1: Graduated Property Tax System for 2025

Source: DOR.

The Legislature also provided a $400 one-time tax rebate for primary residences and long-term rentals.

Recall that the tax rate converts market value to taxable value, a vital part in calculating taxes owed.

Taxes Owed = Market Value x Taxable Rate x (Mills ÷ 1000)

Will the mills remain fixed, or will they float upward when taxable rates fall?

Unfortunately, adjusting the tax rates is not done in isolation, and local tax jurisdictions

often adjust the Mills to offset changes to taxable value so that tax revenue is maintained.

- State-appropriated mills are fixed (95-mill Levy and 6-mill Levy).

- Locally appropriated mills float upwards to maintain property tax revenue. For example, the City of Bozeman increased the mills by 4.5 to cover almost all of the decline in property tax revenue that would have occurred due to lower taxable rates. They also converted fixed mill levies to floating mills.

- Only two cities — Billings and Sunburst – are unable to float their mills upward without a voter-approved referendum.

If mills are fixed:

- ↓ Taxable rate ⇒ ↓ Taxes owed.

- ↑ Taxable rate ⇒ ↑ Taxes owed.

If mills float:

- ↓ Taxable rate ⇒ ↑ mills ⇒ No change to taxes owed.

- ↑ Taxable rate ⇒ ↓ mills ⇒ No change to taxes owed.

How Did These Rate Changes Impact Homeowners?

To understand impacts, let’s use an example of a residential owner whose property

is their primary residence. Suppose the market property value is $671,800, and the

mills are 500 in 2024 and 680 in 2025.

| 2024: |

Taxable Value: $671,800*0.0135 = $9,069 |

| 2025: |

Taxable Value: $399,999*0.0076 + $271,001*0.011 = $6,021 |

Property taxes fall by $440, a 10% decrease.

- Property taxes to the State fall by $322.

- Property taxes to the local jurisdictions fall by $120.

2025 is also a property reassessment cycle year

The Zoomtown boom has stopped, and the demand for MT residential real estate isn’t

as hot. As such, many homeowners saw reductions in their home’s market value. For

example, in Bozeman, there was about a 4% reduction in value for the 2025 cycle.

The 2025 property assessments are based on property values as of January 1, 2024.

Many will see their property values fall during this cycle, and potentially the 2027

reassessment cycle as well. For example, in Bozeman, residential home values fell

by over 11% in the 2nd quarter of 2025, but this won’t be seen until the 2027 tax

bill.

Enacted Property Tax Legislation Impacting 2026

The 2026 tax year will add a Homestead Component to the 2025 graduated property tax rates.

Table 2: Property Tax Rates, 2026

Source: MT DOR 2024 and 2026.

Homestead Owner Eligibility:

- Individual-owned or grantor revocable trusts.

- Principal residence and lived on the property for 7 months of the year.

- Current on property taxes.

- Those who received the 2025 tax rebate are already enrolled.

Homestead Long-term Rental Eligibility:

- Tenant residence and rented to tenants for a minimum of 28+ days and for at least 7+ months a year.

- Current on property taxes.

- Must apply between Dec. 1, 2025 and Mar. 1, 2026.

Homestead Enrollment: https://revenue.mt.gov/property/property-tax-changes/homesteads-and-long-term-rentals

Homestead Enrollment Verification: https://svc.mt.gov/dor/OrionDataPortal/HomesteadExemption.aspx

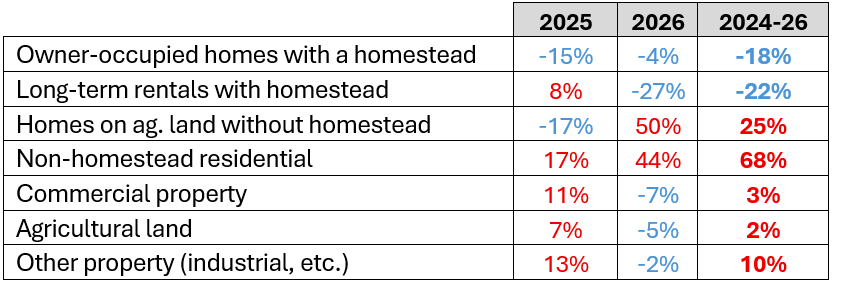

The DOR’s projected tax impacts between 2024 and 2026

The DOR provided preliminary analysis of the impact of the new tax changes.

Table 3: Estimated Change in Property Taxes

Source: DOR.

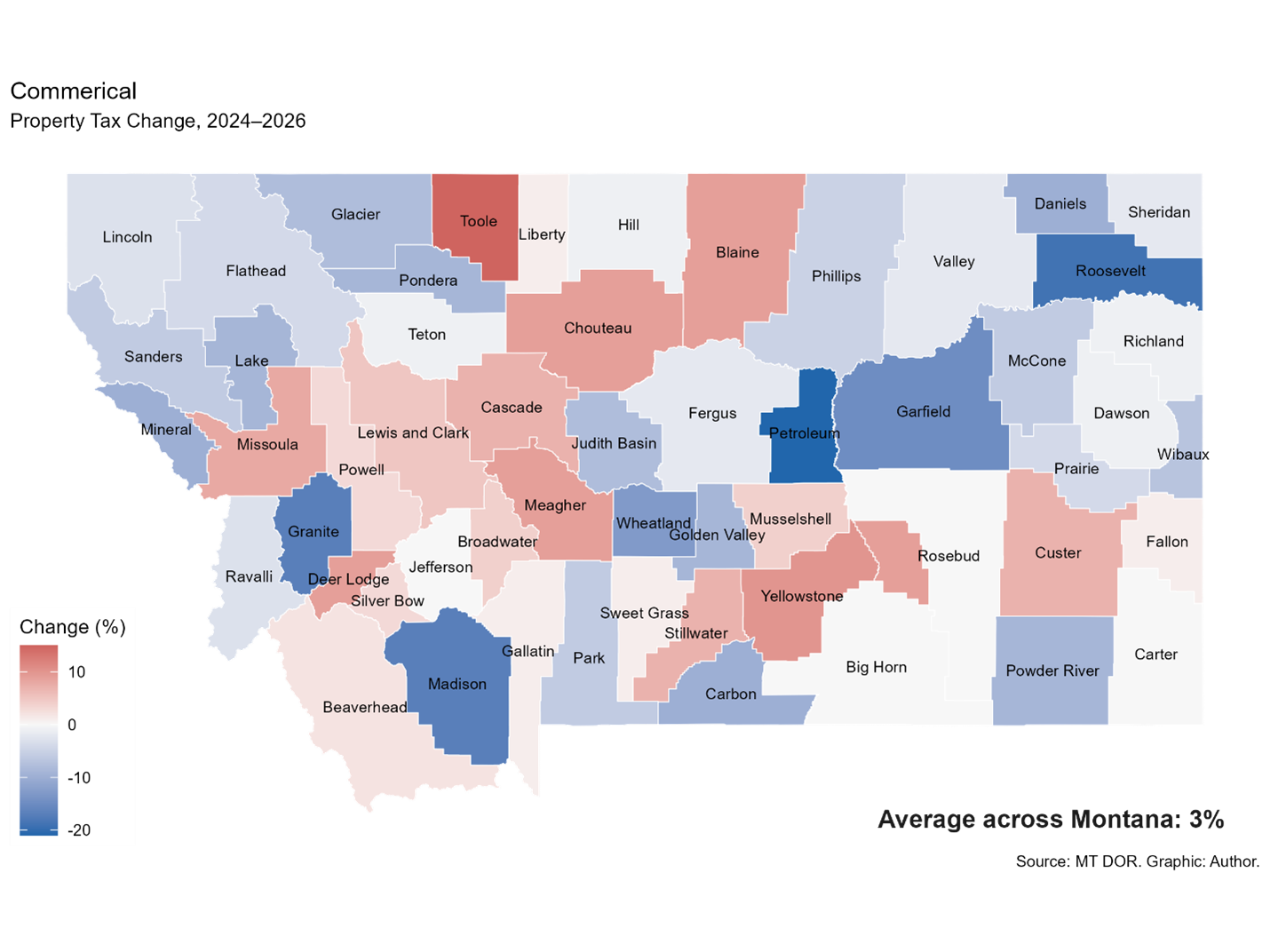

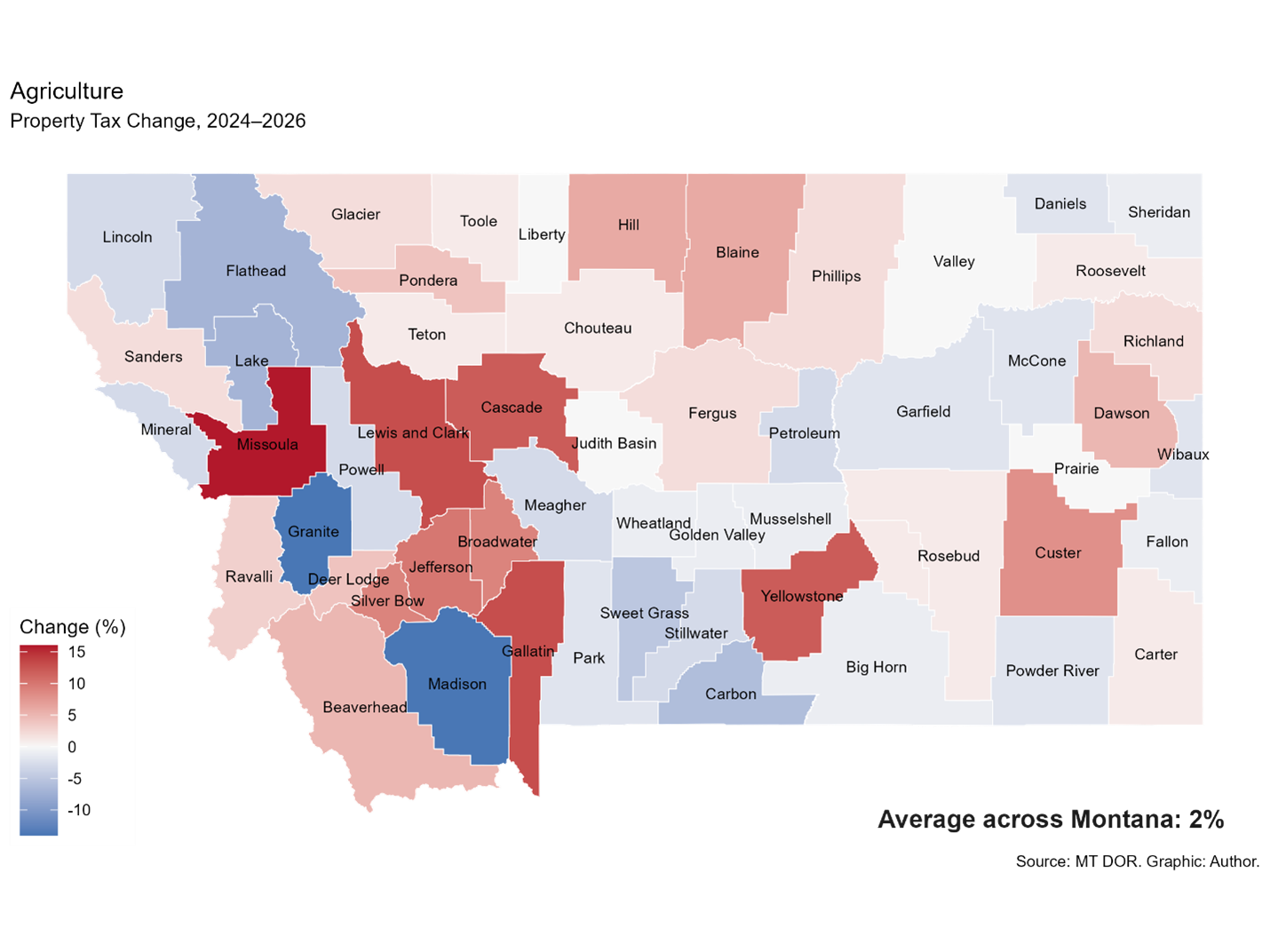

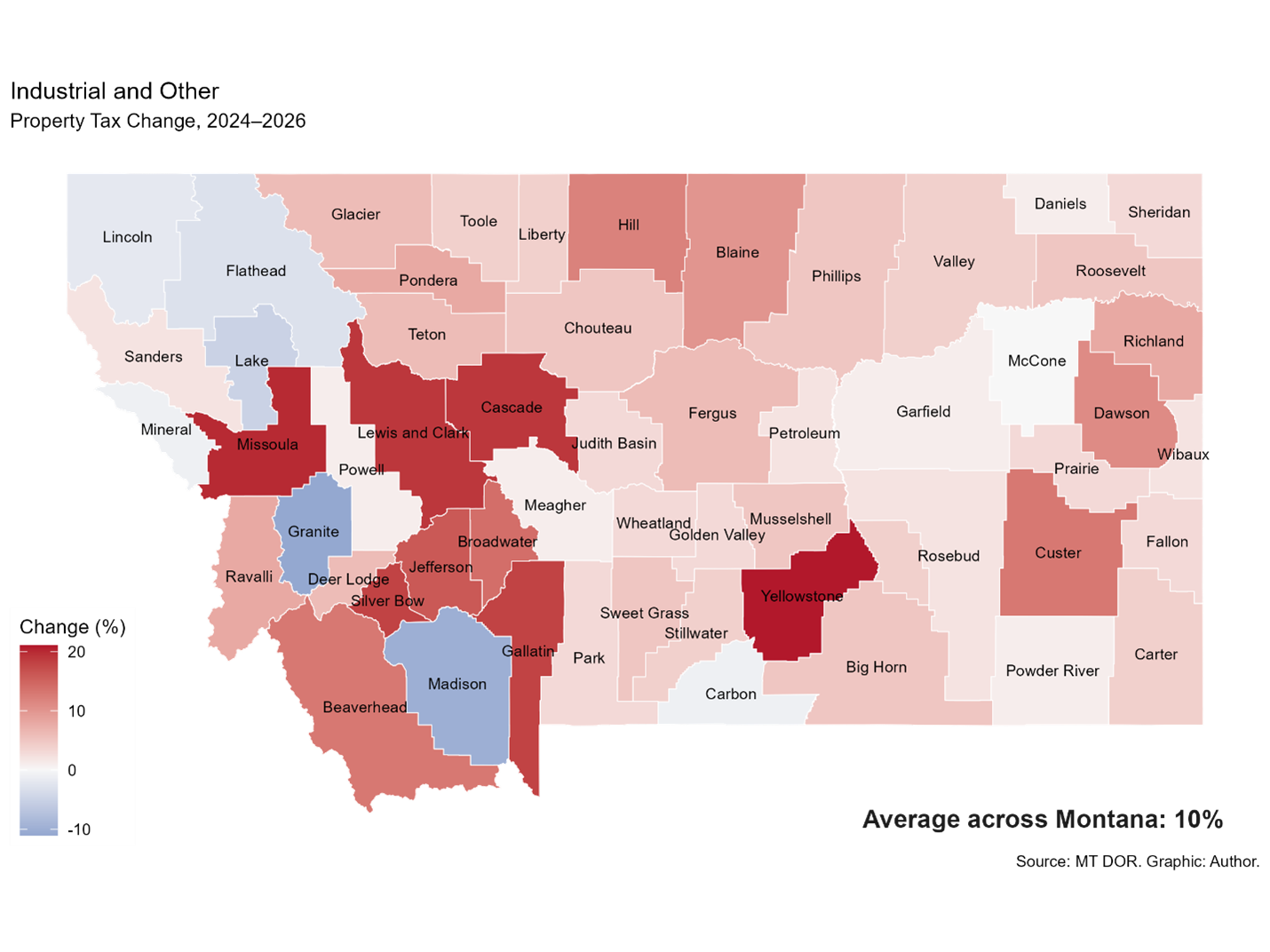

This legislation is intentionally redistributive, offering lower taxes to some properties and higher taxes to others.

- Overall, little to no change to total taxes paid.

- All homeowners will see reductions in property taxes owed to the State, except those with property values above $3.2 million.

- Many homeowners will see their property tax bills decrease slightly, except for those with higher property values.

- Compared to 2022, many homeowners will still face higher overall tax bills.

- Shifts tax burden between properties:

- Decrease in residential taxes.

- Increase in agricultural and commercial taxes.

- Increase in industrial property taxes, though the PSC reduced NW Energy’s property taxes by $75M in 2023. These taxes pass through to customers.

- Shifts tax burden within property classes from lower-valued to higher-valued properties

These effects were known before enactment.

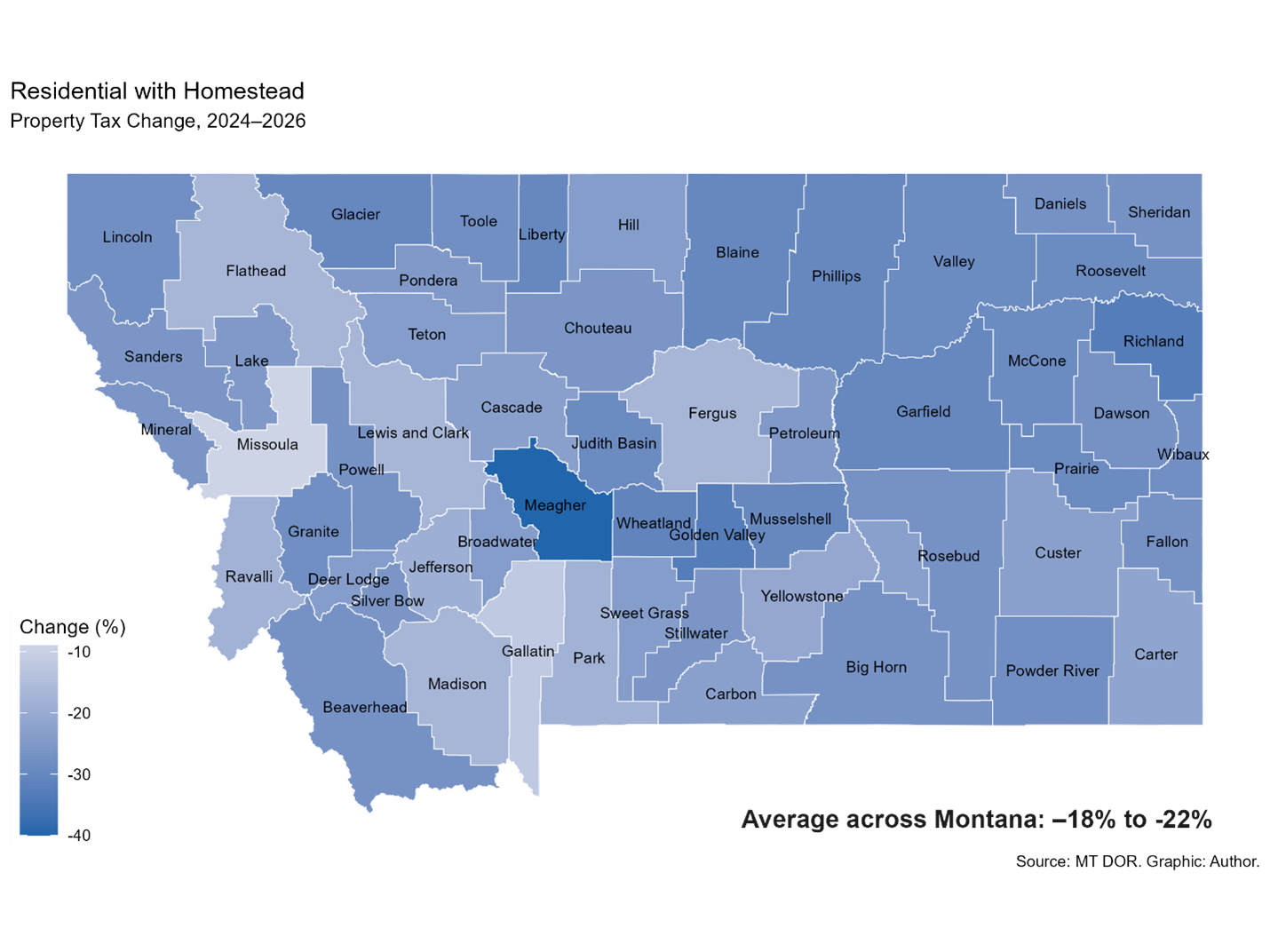

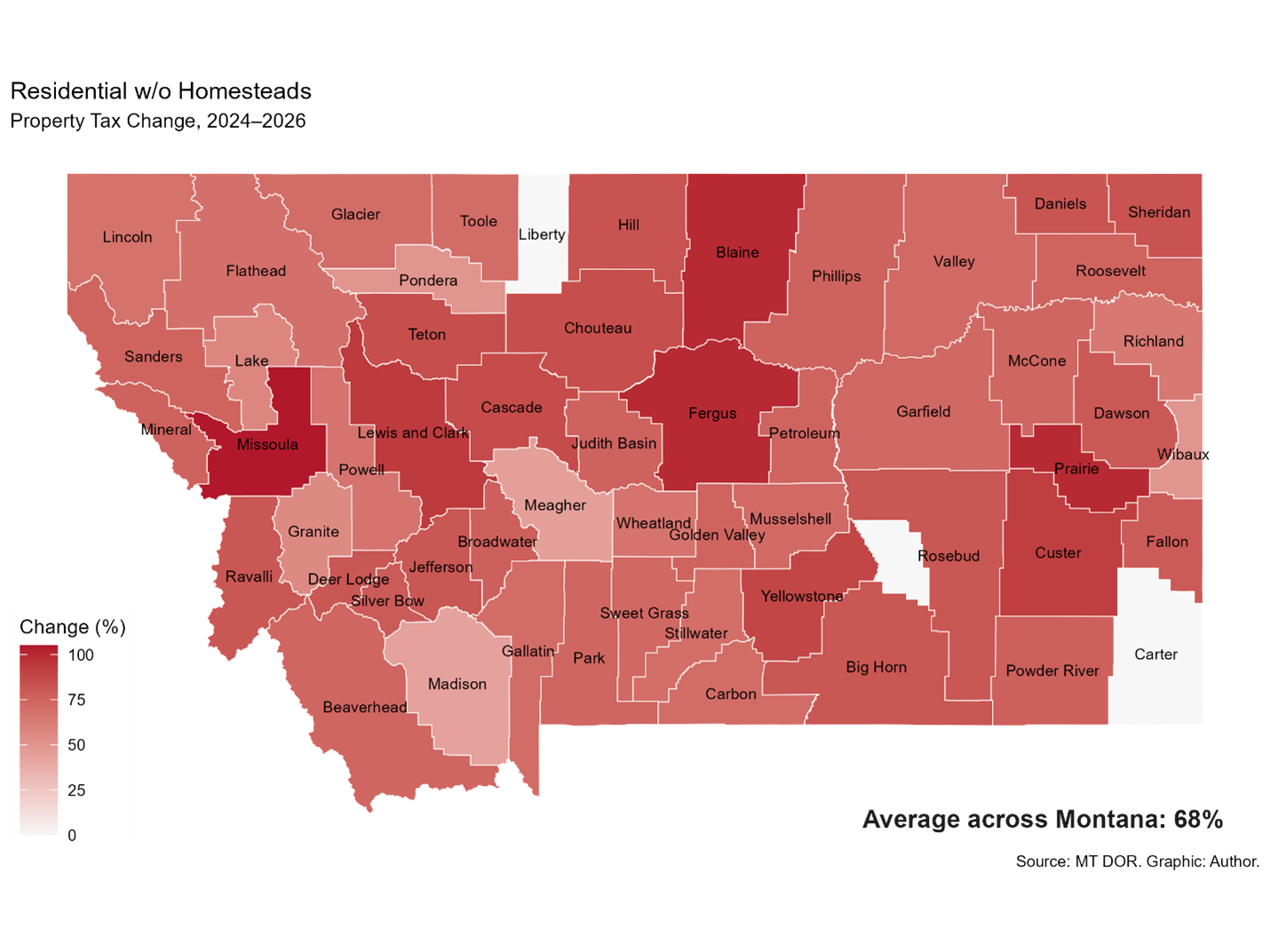

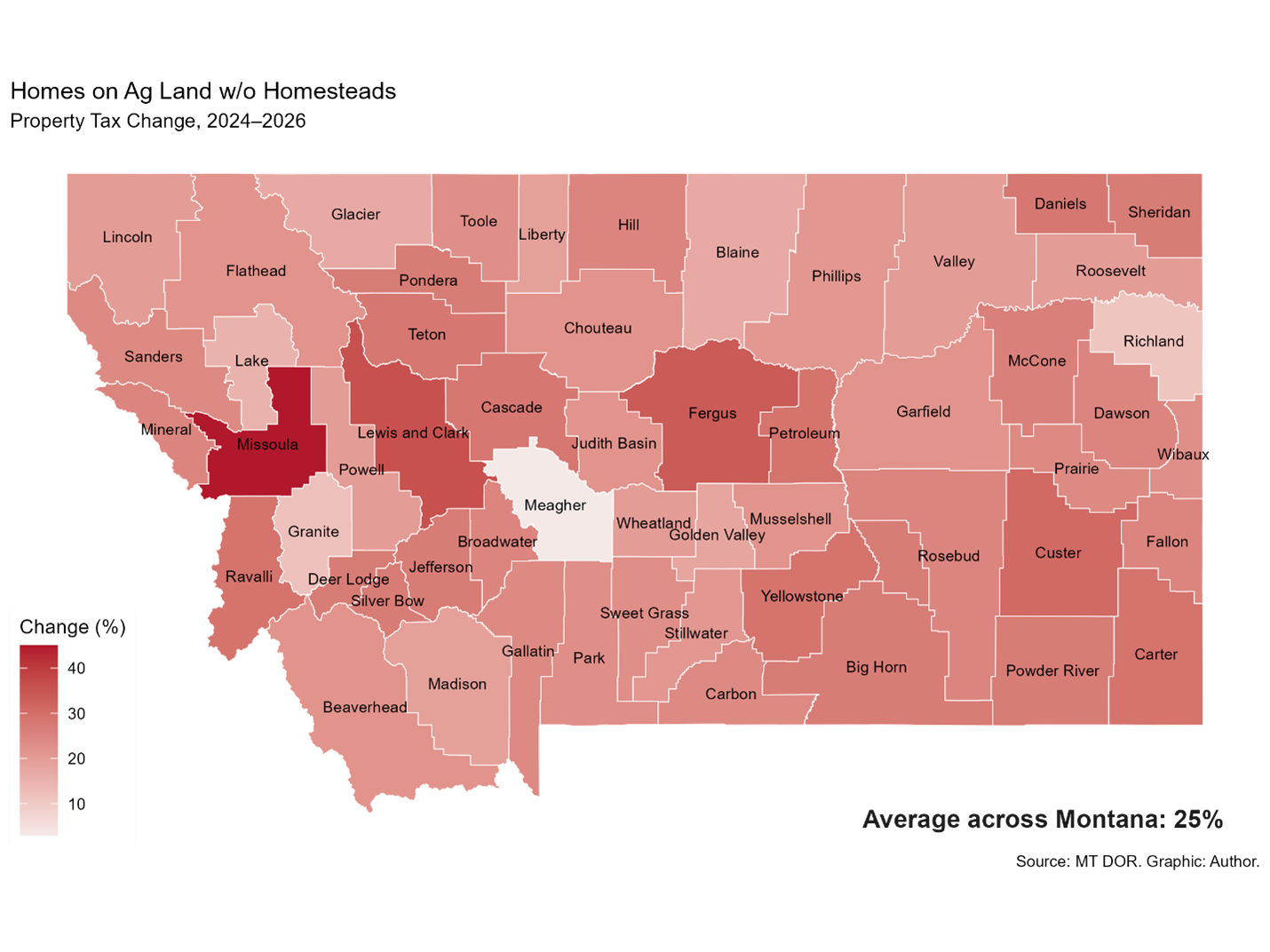

County-by-County Impacts

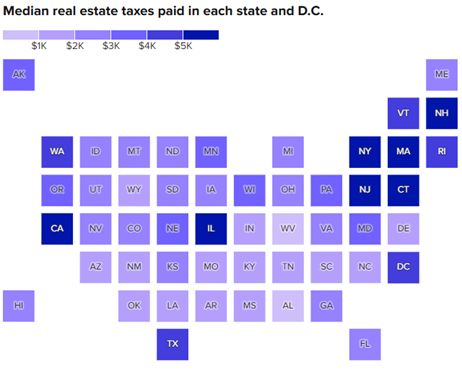

How does Montana compare to other states?

Montana’s property tax burden is in the middle of the pack, but higher than our neighboring states: Idaho, Utah, Wyoming, North Dakota, and

Colorado. We are slightly below South Dakota.

Source: American Community Survey, 2023

All Is Not Well on the Home Front

Currently, there is a lawsuit in Butte-Silver Bow County in which Plaintiffs argue

that the MT DOR did not equalize taxes as required by the MT Constitution, Article VIII.

The Montana Legislature has at times enacted ‘value-neutral rates’ and, in other years,

departed from them. I have already provided a detailed analysis of how the property tax burden has shifted over time across Montana.

It will be surprising if the Plaintiffs succeed, as this type of legal argument has

failed in the past.

This is Part 8 of a Series on Property Taxation in Montana.

See Other Related Blog Posts:

- Understanding Your Property Tax Bill: A Step-by-Step Guide Part 1 Update for the 2025 Tax Year

- Why Did My Property's Taxes Increase? Part 2

- The Fixed Mill Levy Issue: Why Montana's 95 Mill Levy is Unsustainable in the Long Run Part 3

- Tax Policies and Shifting Tax Burden Between Property Classes Across Montana Part 4

- The Economics of Property Tax Policies Part 5

- The Economics of Property Tax Force Recommendations Part 6

- Current Property Tax Proposals in the 69th Montana Legislature Part 7

Greg Gilpin

Professor

Montana State University is an ADA/EO/AA/Veteran’s Preference Employer and Provider of Educational and Outreach.

Source: See Lees/Francesco Scatena

Source: See Lees/Francesco Scatena